It’s a normal part of life to face money troubles from time to time, but the main thing is to know the way out of such problems. Texas Auto Loan is always at your disposal. It provides an Auto Title Loan even for those with bad credit scores. Traditional lenders usually refuse to approve your loan application if your credit isn’t good. If it is your case, you can try to receive money with an Auto Loan. Your car will be used as collateral for the loan. Usually, you can be approved on the same day you apply.

LEGISLATIONS FOR AUTO LOANS IN TEXAS

Looking for a title loan can be a stressful process, especially when the various states have different laws that can affect your chances of receiving funding. Some of the states offer better terms and rates than others. You should consider your state’s rules when you decide to apply for a loan.

All in all, almost every state’s lenders offer quick and easy online applications. All you need to do to get some money quickly is to fill out a simple online application form. This process will only take 5 to 10 minutes.

Texas law says that auto loan lenders must have a license and follow strict regulations exists. The aim of these regulations is to limit a loophole that makes it possible for Credit Access Businesses to escape licensing and regulations. This also touches moneylenders who offer finances with the help of third-party organizations. At this point, a company is considered to be a credit services organization.

In some states, there is a limit on the amount of money that you can apply for. For instance, in the city of Killeen, works a new law. This law requires that car lenders make certain you don’t borrow an amount of money that is more than 20% of your monthly salary.

Online Car Title Loan in Texas uses your vehicle as the collateral for your loan. You can get money quickly to cover your unexpected expenses or pay your bills with a car loan. For instance, it is quite convenient to get online car loan without inspection in Texas on Pitri Loans and you will not meet any restrictions. With all the required documents you provide, the lender will usually approve the loan with an offer for fast financing within 1–2 business days. The interest rate, repayment amount, and terms depend on your credit score, creditworthiness, the demanded sum of the loan, and similar factors.

In order to be approved for a car loan in Texas, a specialist must estimate the value of your vehicle. The loan amount will depend on many factors such as the make of the car mileage, the year, make, model, and the condition of the vehicle also affects the overall loan amount that you can qualify for.

IS IT POSSIBLE TO HAVE A CAR ESTIMATION WITHOUT A STORE VISIT?

Take some photos of your car with your phone or camera and then upload them with your online application, email them, or send them directly to the lender.

The pictures will help the lender to verify the car’s condition, make, model, year, and mileage to determine the overall value of the car in order to approve you for the necessary loan amount. The process is fast, easy, safe, and much more convenient than driving to the loan office for an inspection.

INTEREST RATES IN TEXAS

How do interest rates work? Usually, they are based on your credit score information and average income. It happens, that Texas has quite high-interest rates. Consider that having no outstanding loans also plays an important role.

If you have a good credit history along with a regular salary, you can receive the most favorable rates. Commonly most lenders offer auto loans up to $5,000, however, if you want or need more money, you can find a lender who will lend you up to $10,000. Before applying for a car loan in Texas, it is best to compare what different lenders can offer and choose the best option for your situation or need.

The terms of repayment in Texas will completely depend on the loan amount. Most commonly the repayment terms will start from 12 months and go up to 36 months. You can discuss the terms of loan repayment with the lender and choose the most convenient for you.

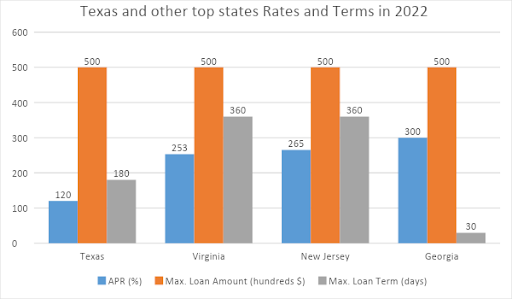

The diagram shows that the maximum loan amount you can receive throughout the country is 50000$ due to Pitriloans.com Texas auto loan regulatory changes in 2022. However, APRs differ from state to state. As we can see, Texas’ APR makes out 120%, which is considerably less than states like Virginia and Georgia can offer. On the other hand, the lesser the APR in Texas is the fewer repayment days we have at our disposal. Texas’ maximum loan term is only 180 days, while other states offer two times more.

Analyzing all pros and cons will definitely help you to find the best option for you!