Uncovering Opportunities and Strategies Trading commodities has long been a key component of global economies, providing investors with a wide range of assets to investigate. In this instructive blog, we delve into the commodity trading industry, examining its distinctive features, key players, and winning strategies.

Explore the commodities market and trade with Wealth Arbitrage to get the best returns.

Understanding Trading in Commodities:

Oil, gold, wheat, and natural gas are examples of commodities, which are real things that make up our daily lives. Buying and selling these raw materials on international exchanges is commodity trading. Commodities are a distinct asset class because, in contrast to other financial instruments, they are influenced by real-world supply and demand dynamics.

The Role of the Commodity Market:

Ware markets assume a basic part of the worldwide economy. They furnish makers with a stage to support against cost variances, empowering solidness in businesses vigorously dependent on unrefined components. In addition, commodity markets are an essential source of investment opportunities because they enable traders to diversify their portfolios and speculate on price movements.

Key Participants in Commodity Trading:

Commodity trading involves multiple stakeholders, each playing a crucial role. These include producers, consumers, traders, speculators, and commodity exchanges. Producers supply the commodities, consumers utilize them in various industries, traders facilitate transactions, speculators capitalize on price volatility, and commodity exchanges act as platforms for buying and selling.

Factors Impacting Item Costs:

Item costs are impacted by a bunch of variables, including worldwide market interest elements, international occasions, weather conditions, and macroeconomic pointers.

Understanding these factors is essential for successful commodity trading as they drive price movements and present lucrative trading opportunities.

Strategies for Commodity Trading Success with Wealth Arbitrage:

a. Fundamental Analysis: This strategy involves analyzing supply and demand fundamentals, geopolitical events, weather forecasts, and economic indicators to identify potential price movements. By staying informed about market dynamics, traders can make informed trading decisions.

b. Technical Analysis: Technical analysis involves studying price charts, patterns, and indicators to forecast future price movements. It helps traders identify trends, support, and resistance levels, and entry/exit points, providing valuable insights for decision-making.

c. Spread Trading: Spread trading involves simultaneously buying and selling related commodities to exploit price differentials. For example, a trader may buy crude oil futures and sell gasoline futures if they anticipate a widening spread between the two.

d. Seasonal Trading: Certain commodities exhibit seasonal patterns due to factors like weather and harvest cycles. Traders can capitalize on these patterns by entering positions aligned with historical price trends during specific times of the year.

e. Risk Management: Commodity trading involves inherent risks due to price volatility. Effective risk management strategies, such as setting stop-loss orders, diversifying portfolios, and managing leverage, are crucial for protecting capital and mitigating losses.

The Role of Wealth Arbitrage in Commodity Trading:

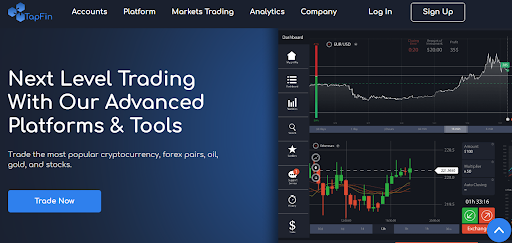

Wealth Arbitrage, a renowned trading portal can make your job a lot easier when it comes to investing in commodities. Using their platform you can trade in commodities and various other assets like stocks, crypto, etc. By leveraging its extensive network and market insights, Wealth Arbitrage enables investors to navigate the complexities of commodity trading with confidence along with an easy-to-use and interactive interface.

Commodity trading offers a realm of possibilities for investors seeking exposure to the global economy. Understanding the intricacies of commodity markets, and key influencers of prices, and implementing effective trading strategies are vital for success.