In today’s fast-paced world, managing your finances effectively is more crucial than ever. Whether you’re just starting your career or planning for retirement, having a solid grasp on your financial situation can make a world of difference. This article will walk you through essential tips and tricks for better financial management, helping you build a secure future and achieve your financial goals.

Set Clear Financial Goals

The cornerstone of any successful financial plan is a set of clear, well-defined goals. Without a clear direction, it’s easy to lose focus and motivation in your financial journey.

Identify Your Priorities

Take time to reflect deeply on what you want to achieve financially. This process involves introspection and honest assessment of your current situation and future aspirations. Common financial goals include:

- Saving for a down payment on a house

- Paying off student loans or credit card debt

- Building an emergency fund

- Saving for retirement

- Funding your children’s education

Each of these goals requires different strategies and timelines. For instance, saving for a house down payment might be a medium-term goal, while planning for retirement is typically a long-term objective.

Make Your Goals S.M.A.R.T.

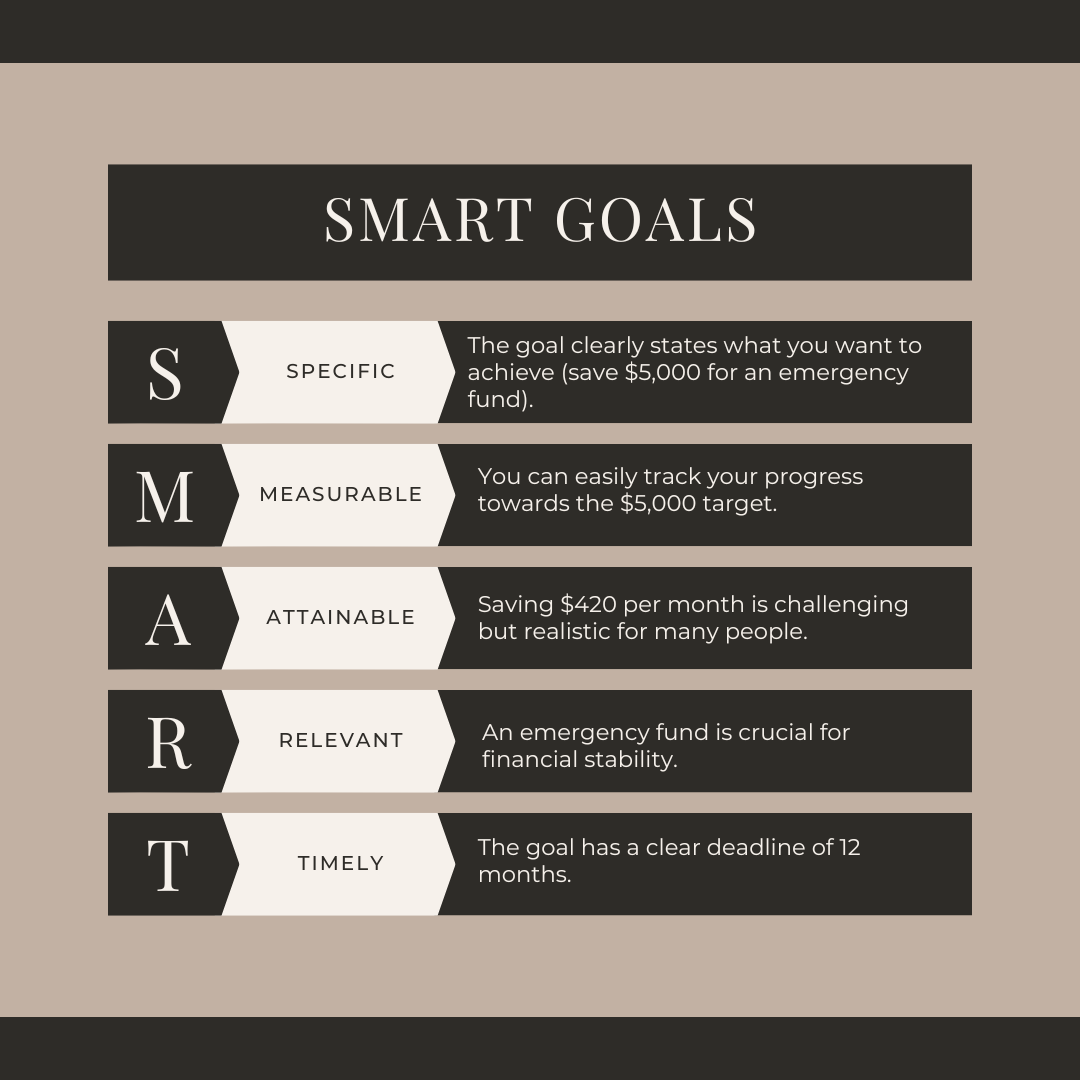

To increase your chances of success, ensure your goals are Specific, Measurable, Attainable, Relevant, and Time-bound (S.M.A.R.T.). This framework helps transform vague aspirations into concrete, actionable plans.

Let’s break down this S.M.A.R.T. goal:

This S.M.A.R.T. goal gives you a clear target and timeline, making it easier to track your progress and stay motivated. It also allows you to break down the larger goal into smaller, monthly targets, making it feel more manageable.

Create and Stick to a Budget

A budget serves as your financial roadmap, guiding you towards your goals. It helps you understand your cash flow, identifying areas where you can reduce spending or increase savings.

Choose a Budgeting Method

Several popular budgeting methods exist, each with its strengths. Consider these options:

50/30/20 Rule: This method suggests allocating 50% of your income to needs (like housing, food, and utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. It’s simple and flexible, making it a good starting point for many.

Zero-Based Budgeting: In this approach, you assign every dollar a specific job, ensuring your income minus expenses equals zero. This method requires more detailed planning but can lead to more intentional spending.

Envelope System: Traditionally, this involved using physical envelopes for different expense categories. Modern versions use digital “envelopes” or categories in budgeting apps. It’s particularly effective for those who struggle with overspending in certain areas.

Pay Yourself First: With this method, you prioritize savings by immediately setting aside a portion of your income for savings goals before budgeting the rest for expenses.

Values-Based Budgeting: This approach aligns your spending with your personal values and life goals. It encourages you to spend more on things that truly matter to you while cutting back on areas that don’t align with your values.

Choose a method that aligns with your personality, lifestyle, and financial goals. The key is to find a system you can stick to consistently. Don’t be afraid to experiment with different methods or even combine aspects of multiple approaches to create a personalized budgeting system that works for you.

Track Your Expenses

Tracking your expenses is crucial for effective financial management. Start by recording all your expenditures, and categorizing them to identify spending patterns. Use budgeting apps or spreadsheets to monitor your daily, weekly, and monthly expenses. This practice helps you stay within your budget, identify areas for savings, and ensure you’re on track to meet your financial goals. Regularly reviewing your expenses allows for adjustments to improve your financial health.

Build an Emergency Fund

Life is unpredictable, and having an emergency fund provides a crucial financial safety net. It can help you avoid going into debt when unexpected expenses arise, reducing financial stress and providing peace of mind.

Start Small, Think Big

While financial experts often recommend an emergency fund covering 3-6 months of living expenses, don’t let this sizeable goal intimidate you. Start with a smaller, more attainable goal, like $500 or $1,000, and build from there.

Here’s a step-by-step approach:

1. Set an initial goal of $1,000. This amount can cover many common emergencies like minor car repairs or unexpected medical bills.

2. Once you reach $1,000, aim for one month of living expenses.

3. Gradually increase your goal to three months, then six months of expenses.

Remember, any amount saved is better than none. Even a small emergency fund can provide a buffer against life’s unexpected events.

Automate Your Savings

Automate your savings to build your emergency fund effortlessly. Set up automatic transfers from your checking to a dedicated savings account. Utilize direct deposit from your paycheck and round-up savings features offered by banks, where purchases are rounded up and the difference is saved. Increase your automatic savings amount whenever you receive a raise or cut expenses. Small, regular contributions grow significantly over time through consistency and compound interest.

Fun Fact: According to a 2021 survey by Bankrate, only 39% of Americans could cover a $1,000 emergency expense from savings. By building your emergency fund, you’re already ahead of the curve.

Remember, an emergency fund should be easily accessible but separate from your everyday spending money. Consider a high-yield savings account for your emergency fund to earn some interest while keeping the funds liquid.

Manage and Reduce Debt

Debt can be a significant roadblock to achieving your financial goals. High-interest debt, in particular, can slow down your progress and cost you significantly over time. Tackling debt head-on is crucial for long-term financial health.

Prioritize High-Interest Debt

Focus on paying off debts with the highest interest rates first. This approach, known as the debt avalanche method, can save you money on interest in the long run. Here’s how it works:

- List all your debts, their balances, and interest rates.

- Continue making minimum payments on all debts.

- Put any extra money towards the debt with the highest interest rate.

- Once the highest-interest debt is paid off, move to the next highest, and so on.

While this method saves the most money overall, some people prefer the debt snowball method, which involves paying off the smallest debts first for psychological wins. Choose the method that motivates you the most.

Regional Debt Challenges and Solutions

Different regions face unique economic challenges that can impact personal debt levels. In Indiana, for example, factors such as fluctuations in manufacturing employment and agricultural commodity prices can affect residents’ financial stability. Hoosiers facing overwhelming debt might find it helpful to explore debt relief Indiana options.

Indiana debt relief programs offer various solutions for those struggling with financial hardship. These can include:

- Credit counseling: Professional advisors can help you understand your financial situation and develop a plan to manage your debt.

- Debt consolidation: This involves combining multiple debts into a single loan, potentially with a lower interest rate. Debt consolidation in Indianapolis and other cities can simplify payments and reduce overall interest costs.

- Debt settlement: This process involves negotiating with creditors to reduce the amount owed. While it can provide relief, it’s important to understand the potential impacts on your credit score.

- Hardship relief: Some lenders offer hardship programs or loans for those experiencing temporary financial difficulties.

When considering how Indiana debt relief works, it’s crucial to research thoroughly and understand the terms of any program you’re considering. While many reputable organizations exist, always be cautious and verify the legitimacy of any debt relief service. Look for Indiana debt relief reviews from reliable sources, and be wary of promises that seem too good to be true.

Remember, what works best depends on your financial situation. Whether you’re looking into debt consolidation mortgage loans in Indiana or exploring other debt-relief options, it’s often helpful to consult with a financial advisor who can provide personalized guidance.

By addressing your debt proactively and choosing the right debt relief strategy, you can work towards regaining control of your finances and building a more stable financial future.

Consider Debt Consolidation

If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can simplify your payments and potentially save you money. Options for debt consolidation include:

- Personal loans from banks or credit unions

- Balance transfer credit cards with 0% introductory APR offer

- Home equity loans or lines of credit (if you’re a homeowner)

Before consolidating, carefully compare the terms, fees, and interest rates of different options. Ensure that the new loan truly saves you money in the long run.

Avoid New Debt

While paying off existing debts, it’s crucial to avoid accumulating new ones. This might require lifestyle changes and careful budgeting. Consider these strategies:

- Use cash or a debit card for purchases to avoid accumulating more credit card debt.

- Create a spending plan before making major purchases.

- Look for ways to reduce expenses, such as cutting subscriptions or negotiating bills.

- Build an emergency fund to avoid relying on credit for unexpected expenses.

Remember, getting out of debt is a journey that requires patience and persistence. Celebrate small victories along the way to stay motivated.

Optimize Your Income

Increasing your income can accelerate your progress toward financial goals. While this often requires effort and time, the long-term benefits can be substantial.

Negotiate Your Salary and Benefits

Don’t be afraid to ask for what you’re worth. Many people leave money on the table by not negotiating their compensation. Research industry standards, document your achievements, and practice your pitch. Consider the entire compensation package, including benefits and work-life balance. Approach negotiations professionally and be prepared to make a strong case for a raise or better benefits.

Explore Side Hustles

In today’s gig economy, there are numerous opportunities to supplement your income. Consider freelance writing, graphic design, driving for ride-sharing services, tutoring, selling handmade items, renting out a spare room, or offering pet-sitting services. Choose a side hustle that aligns with your skills and interests while being mindful of tax implications and keeping accurate records.

Invest in Your Skills

Continuous learning and skill development can increase your earning potential. Take online courses, pursue relevant certifications, learn in-demand skills like coding or digital marketing, network with professionals, and seek mentorship opportunities. Investing in yourself often yields the highest returns, providing opportunities for both personal and professional growth.

Plan for Retirement

It’s never too early to start planning for retirement. The power of compound interest means that even small contributions made early in your career can grow significantly over time.

Maximize Employer-Sponsored Plans

If your employer offers a 401(k) or similar retirement plan, take full advantage of it, especially if they offer matching contributions. Employer matching is essentially free money, so try to contribute at least enough to get the full match. Contributions are typically made with pre-tax dollars, reducing your current taxable income.

Many plans offer a range of investment options, allowing you to diversify your portfolio. If you’re self-employed, consider options like a Solo 401(k) or SEP IRA, which offer similar tax advantages for retirement savings.

Consider Individual Retirement Accounts (IRAs)

In addition to employer-sponsored plans, consider opening an IRA. Traditional IRAs often offer tax-deductible contributions with tax-deferred growth, meaning you pay taxes when you withdraw the money in retirement.

Roth IRAs, on the other hand, are funded with after-tax dollars, but qualified withdrawals in retirement are tax-free, which can be beneficial if you expect to be in a higher tax bracket in retirement. Each type of IRA has its own eligibility requirements and contribution limits, so research both options to determine which best fits your financial situation and goals.

Diversify Your Investments

Don’t put all your eggs in one basket. Spreading your investments across different asset classes can help manage risk and maximize potential returns. Common asset classes include stocks, bonds, real estate, and cash. Your ideal asset allocation depends on factors like your age, risk tolerance, and financial goals.

Younger investors can afford to take on more risk for potentially higher returns, while those closer to retirement might prefer a more conservative approach. Consider using low-cost index funds or target-date funds, which automatically adjust your asset allocation as you approach retirement age.

Regularly Review and Adjust Your Financial Plans

Your financial situation and goals may change over time. Regular reviews ensure your financial strategy remains aligned with your current circumstances and long-term objectives.

Schedule Financial Check-Ups: Set regular intervals, such as annually or semi-annually, to review your financial plans. Assess your progress toward goals, evaluate your budget, and make necessary adjustments.

Stay Flexible: Life events like job changes, marriage, or having children can impact your financial plans. Be prepared to adjust your strategy to accommodate these changes, ensuring you remain on track.

Seek Professional Advice: Consider consulting with a financial advisor to gain expert insights. They can provide personalized advice, help you navigate complex financial decisions, and ensure your plans are optimized for your unique situation.

Improve Your Financial Literacy

Enhancing your financial literacy is crucial for informed decision-making. Read financial books like “The Total Money Makeover” by Dave Ramsey and “Rich Dad Poor Dad” by Robert Kiyosaki, and follow reputable financial blogs and podcasts for ongoing education.

Many banks, credit unions, and community organizations offer free financial education workshops covering budgeting basics, understanding credit, investing fundamentals, retirement planning, and the home-buying process. Check with your local library, community center, or financial institutions for upcoming events, and take advantage of online webinars.

Utilize online resources like Investopedia, NerdWallet, and Khan Academy for free courses and articles. Always verify the credibility of sources and be cautious of advice that seems too good to be true.

Protect Your Financial Future

While building wealth is important, protecting it is equally crucial.

Review Your Insurance Coverage

Ensure you have adequate health, life, disability, home or renters, and auto insurance. Adequate coverage can protect you from financial hardships caused by unexpected events and ensure your financial stability.

Create or Update Your Will

A will ensures your assets are distributed according to your wishes in the event of your passing. Regularly updating your will can provide peace of mind and prevent legal complications for your loved ones.

Monitor Your Credit Report

Regularly check your credit report for errors or signs of identity theft. You’re entitled to one free credit report from each of the three major credit bureaus annually. Monitoring your credit helps maintain your financial health and prevents potential identity theft issues.

Practice Mindful Spending

Being more conscious about your spending can help you save money and align your purchases with your values and goals.

Implement the 24-hour Rule: For non-essential purchases, wait 24 hours before buying. This cooling-off period can help you avoid impulse purchases.

Focus on Experiences Over Things: Research shows that spending money on experiences often leads to greater long-term happiness than buying material goods.

Practice Gratitude: Regularly expressing gratitude for what you have can reduce the urge to spend unnecessarily and increase overall life satisfaction.

FAQs

How much should I save for an emergency fund?

Aim to save three to six months’ worth of living expenses. Start with a smaller goal, like $1,000, and gradually build up from there. Remember, any amount saved is better than none.

How can I optimize my budget?

Choose a budgeting method that fits your lifestyle, like the 50/30/20 rule. Track your expenses diligently and review your budget regularly. Be willing to adjust categories as needed, and look for areas where you can cut back on non-essential spending.

How often should I review my financial plans?

Aim to review your financial plans at least once a year, or whenever you experience a significant life change (marriage, new job, having a child). Quarterly check-ins on your budget and investment performance can help you stay on track.

Should I pay off debt or save for retirement first?

Ideally, you should do both. Start by contributing enough to your employer’s retirement plan to get any matching contributions. Then focus on paying off high-interest debt. Once high-interest debt is manageable, increase your retirement savings.

How can I increase my income?

Consider negotiating a raise at your current job, looking for higher-paying positions, or starting a side hustle. Develop new skills that are in demand in your industry to increase your earning potential.

Conclusion

Mastering financial management is a lifelong journey, but implementing these tips and tricks can set you on the path to financial success. Remember, small steps taken consistently can lead to significant results over time. Start with one or two areas you’d like to improve, and gradually incorporate more strategies as you become more comfortable.

Remember, financial management is not about depriving yourself, but about making informed decisions that align with your values and long-term goals. With patience, persistence, and the right strategies, you can achieve financial stability and peace of mind.